In class, we learned about a few different AI tools that teachers can use to create rubrics, lesson plans, generate ideas, write student feedback and emails, and more. I chose to explore the Magic School platform for unit planning. I also compared Magic School to Chat.GPT to see which AI tool could generate a better unit plan outline on which I could base some of my planning.

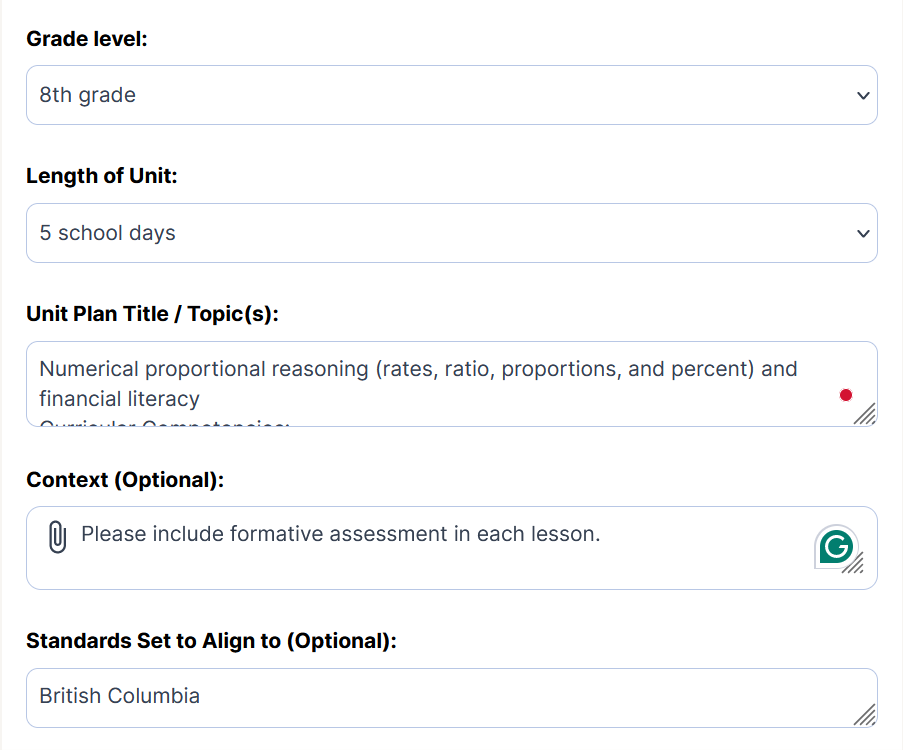

I started by using the Unit Plan Generator on Magic School, and filling in the grade level, length of unit, unit topics and curricular competencies, and I also asked the generator to include formative assessment.

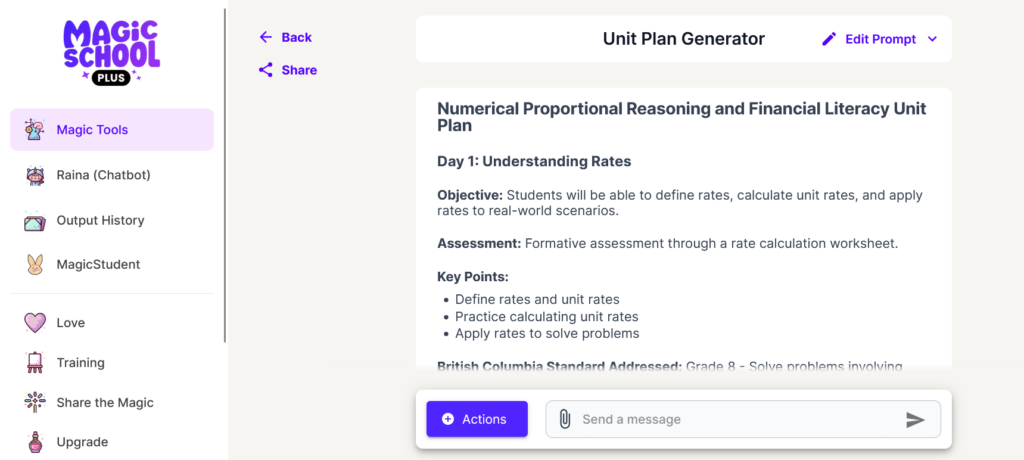

Numerical Proportional Reasoning and Financial Literacy Unit Plan

Day 1: Understanding Rates

Objective: Students will be able to define rates, calculate unit rates, and apply rates to real-world scenarios.

Assessment: Formative assessment through a rate calculation worksheet.

Key Points:

- Define rates and unit rates

- Practice calculating unit rates

- Apply rates to solve problems

British Columbia Standard Addressed: Grade 8 – Solve problems involving rates (e.g., speed, unit pricing) using proportional reasoning.

Day 2: Exploring Ratios

Objective: Students will understand ratios, simplify ratios, and use ratios in various contexts.

Assessment: Formative assessment through a ratio simplification quiz.

Key Points:

- Define ratios and equivalent ratios

- Simplify ratios to their simplest form

- Apply ratios to solve problems

British Columbia Standard Addressed: Grade 8 – Demonstrate an understanding of ratios and proportions concretely, pictorially, and symbolically.

Day 3: Introduction to Proportions

Objective: Students will be able to define proportions, identify proportional relationships, and solve proportion problems.

Assessment: Formative assessment through a proportion matching activity.

Key Points:

- Define proportions and identify proportional relationships

- Solve proportion problems using cross-multiplication

- Apply proportions in real-life scenarios

British Columbia Standard Addressed: Grade 8 – Solve problems involving proportional reasoning in a variety of contexts.

Day 4: Understanding Percentages

Objective: Students will understand percentages, convert between fractions, decimals, and percentages, and apply percentages in financial situations.

Assessment: Formative assessment through a percentage conversion task.

Key Points:

- Define percentages and their relationship to fractions and decimals

- Convert between fractions, decimals, and percentages

- Apply percentages in financial literacy scenarios

British Columbia Standard Addressed: Grade 8 – Apply knowledge of rates, ratios, and proportional reasoning to financial literacy situations.

Day 5: Financial Literacy Application

Objective: Students will apply their knowledge of rates, ratios, proportions, and percentages to real-life financial situations.

Assessment: Formative assessment through a financial literacy problem-solving task.

Key Points:

- Apply numerical proportional reasoning skills to financial scenarios

- Make informed decisions based on mathematical reasoning

- Reflect on personal financial choices

British Columbia Standard Addressed: Grade 8 – Use mathematical arguments to support personal financial choices.

Culminating Activities Suggestions

- Create a budget plan for a hypothetical scenario using rates, ratios, and percentages.

- Analyze different financial documents (e.g., bank statements, invoices) to identify proportional relationships.

- Present a financial literacy project that incorporates numerical proportional reasoning concepts.

Standards Addressed:

- Grade 8 – Apply mathematical concepts to personal financial situations using rates, ratios, and proportions.

See the full unit plan generated by Magic School above – I liked that it told me how the curricular competencies that I provided connect to each lesson. I also liked the formative assessment concepts that it gave for each lesson, and that it provided suggestions for culminating activities at the end. It would be great if it could have provided similar suggestions for each formative assessment, or any idea suggestions for activities throughout the unit. All in all, it gave me an organized template that I could potentially use to create a full unit plan.

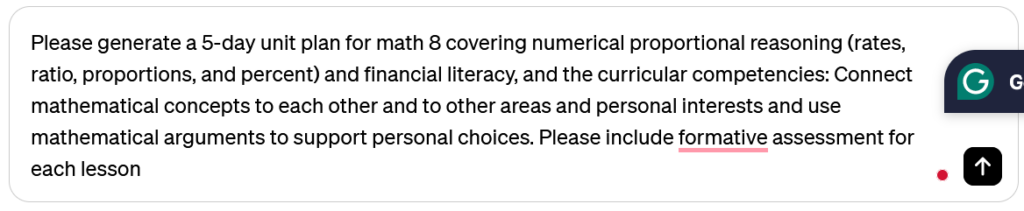

I gave a similar prompt to Chat.GPT, stating the grade, subject, length of the unit, topics and curricular competencies, and to include formative assessment for each lesson.

The unit plan created by Chat.GPT:

Day 1: Introduction to Ratios and Rates

Objective:

- Understand the concept of ratios and rates.

- Represent ratios in different forms.

- Solve problems involving rates and unit rates.

Lesson Activities:

- Start with a real-life scenario to introduce the concept of ratios and rates.

- Discuss the difference between ratios and rates.

- Engage students in hands-on activities to create and compare ratios.

- Introduce unit rates and practice calculating them.

- Solve word problems involving rates.

Formative Assessment:

- Class discussion on ratios and rates.

- Quick exit ticket with a couple of rate problems.

Day 2: Exploring Proportions

Objective:

- Understand the concept of proportions.

- Solve problems involving direct and inverse proportions.

Lesson Activities:

- Review ratios and rates from the previous lesson.

- Introduce the concept of proportions and explain the cross-multiplication method.

- Engage students in various activities to solve proportion problems.

- Solve real-world problems using proportions.

- Discuss how proportions are used in daily life and other subjects.

Formative Assessment:

- Peer assessment of proportion problem-solving in pairs.

- Quick quiz on solving proportions.

Day 3: Percentages and Applications

Objective:

- Understand the concept of percentages.

- Solve problems involving percentages.

- Apply percentages in real-life situations.

Lesson Activities:

- Start with a discussion on the meaning of percentages.

- Teach different methods of calculating percentages.

- Engage students in practical examples involving percentages.

- Apply percentages to financial scenarios, such as discounts, taxes, and interest rates.

- Connect percentages to real-life financial literacy situations.

Formative Assessment:

- Group discussion on solving percentage problems.

- Short quiz on percentage calculations.

Day 4: Financial Literacy: Budgeting and Saving

Objective:

- Understand the importance of budgeting and saving.

- Apply mathematical concepts to create a budget.

- Analyze the impact of saving on financial goals.

Lesson Activities:

- Introduce the concept of budgeting and its importance.

- Engage students in creating a simple budget using their understanding of ratios and percentages.

- Discuss the role of saving money and its impact on financial goals.

- Analyze different saving strategies and their mathematical implications.

- Connect budgeting and saving to personal financial choices.

Formative Assessment:

- Peer review of budgeting exercises.

- Group discussion on the importance of saving.

Day 5: Personal Finance and Mathematical Arguments

Objective:

- Connect mathematical concepts to personal finance.

- Use mathematical arguments to support personal financial choices.

Lesson Activities:

- Discuss how mathematical concepts learned throughout the week apply to personal finance.

- Engage students in analyzing financial choices using mathematical reasoning.

- Have students present and discuss their financial decisions and the mathematical rationale behind them.

- Connect personal interests to mathematical concepts and financial choices.

- Reflect on the importance of making informed financial decisions.

Formative Assessment:

- Student presentations on personal financial choices and the associated mathematical reasoning.

- Written reflections on the connection between mathematical concepts and personal finance.

Chat.GPT was able to create a much more “usable” unit plan that would only need a few changes to suit my students and make it my own. It provided me with many, detailed activity ideas for each lesson that gave me a solid idea of how I could go about teaching this unit. The “objectives” in each lesson also give me a good starting point that I could use to create original assessment plans or my own activity ideas. The pacing of the unit also seems more realistic for a short, 5-day unit. Finally, I preferred the formative assessment ideas generated by Chat.GPT over Magic School, simply because they give me a stronger starting point and more detailed ideas that I can adapt to my needs.

While both unit plans would require editing before use in the classroom, Magic School’s unit plan needs significant changes and additions before it would be teach-able. Chat.GPT gave me a greater amount of detail and information. I also have seen some stigma around the use of Chat.GPT – kind of as the “face” of AI in general, and as Magic School was created as a tool specifically for teachers, it may be more acceptable to use and cite the program. Either way, I don’t see myself using either AI program aside from maybe having help matching curricular competencies to lesson activities, until I have fully learned how to write detailed and appropriate lesson and unit plans on my own.

Leave a Reply

You must be logged in to post a comment.